Lending Infrastructure Intelligent Risk Technology

LendMetrics is a digital credit platform that automates risk assessment, pricing, portfolio monitoring and loan lifecycle management

60%

Improved Efficiency

3-4months

Implementation timeline

End-to-end

Credit + operations

Portfolio Snapshot

Bridge Capital Fund

Active Exposure

R215m

Weighted Rating

BB+

Probability of Default

7,43%

Risk by Product Type

Built for lenders across Africa & emerging markets

A single platform for credit risk, pricing, portfolios, and lifecycle management.

LendMetrics integrates and automates credit lifecycle and removes spreadsheets and fragmented tools.

Credit Risk Engine

Automated Credit Risk Analysis incorporating the four C’s of Credit i.e Character, Capacity, Capital and Collateral.

Risk-Based Pricing Engine

Real-time pricing recommendations based on risk, cost of funds, margins and tenor – with full audit trail.

Loan Lifecycle Management

Manage the full lifecycle – approval, disbursement, monitoring and settlement – in one system.

Portfolio & Exposure Analytics

Real-time view across products, sectors, off-takers and regions – with early-warning signals.

Compliance & Audit Trail

Embedded controls for approvals, user roles and audit logs – aligned to banking and credit governance.

Document & Data Intake

Centralised capture of financials, contracts, KYC and supporting documents – linked to each application.

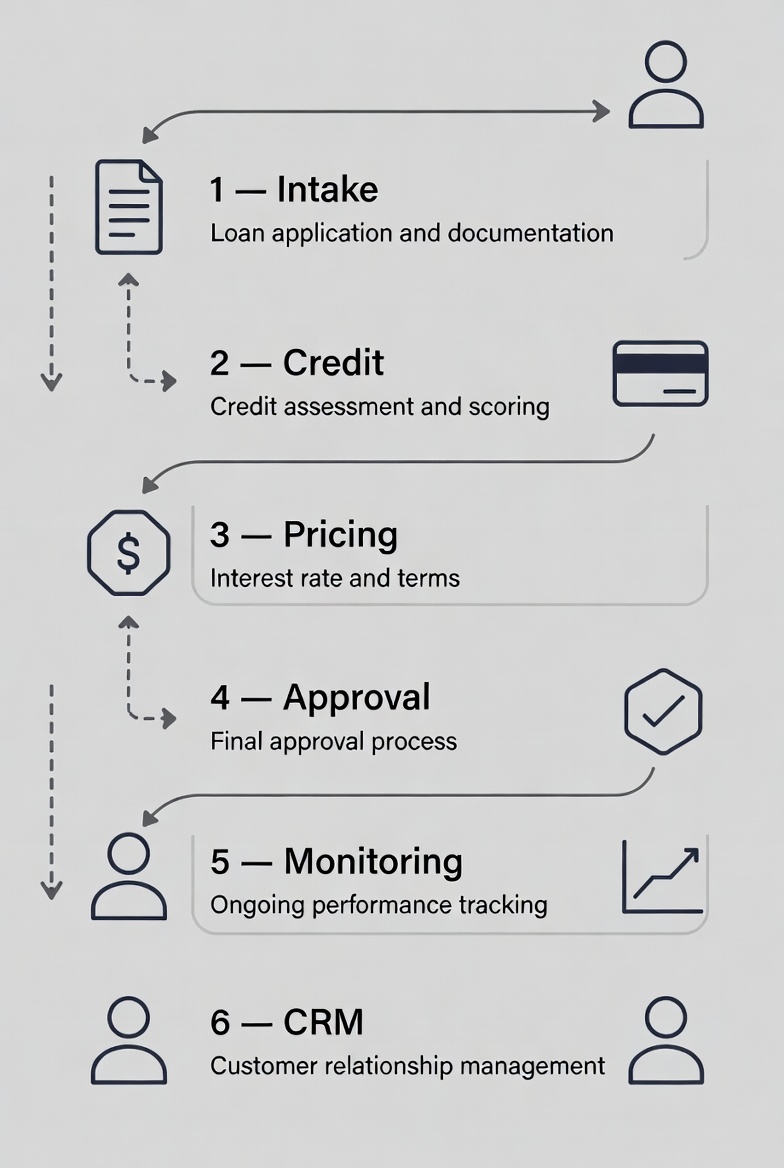

How LendMetrics Fits Into Your Day-to-Day

A clear, structured journey from application to repayment – with risk intelligence embedded throughout.

Intake & KYC

Capture SME, off-taker & contract details.

Credit Assessment

Multi-factor scoring: contract, off-taker & supplier.

Risk-Based Pricing

Automated pricing using PD, LGD, EL & margin.

Approval & Disbursement

Delegated authority routing & payout.

Monitoring & Collections

Repayments, restructures, arrears monitoring.

Client CRM

Statements, loan views, amortisation, settlement letters & messaging.

Real-Time Portfolio & Risk Oversight

Move from static Excel views to interactive dashboards that show exposure, risk and performance by product, sector, region and counterparty – in real time.

- • Drill-down into any entity, off-taker or exposure line in a single click.

- • Track deterioration in credit score, PD or behavioural flags over time.

- • Monitor concentration limits and covenant breaches proactively.

- • Export committee-ready packs and credit review reports in seconds.

Risk Distribution

Portfolio ViewCredit Score

3.08

Probability of Default

4.28%

Expected Loss

R1.15M

Credit Rating

A-

Technology Built for Trust

LendMetrics is engineered on a secure, resilient architecture designed for modern lenders.

Encryption Everywhere

Data encrypted at rest and in transit (TLS/HTTPS).

Atomic Transactions

Operations complete fully or rollback entirely — never partial.

Role-Based Access Control

Access aligned to roles: Admin, Credit, Ops, Collections & Client.

Audit Logging

Every sensitive action logged for compliance and governance.

Secure Cloud Hosting

Hardened servers with strict firewalls and OS security.

Backups & Recovery

Daily encrypted backups with tested restore procedures.

POPIA / GDPR Alignment

Strong privacy, consent, and secure data handling controls.

Firewall Protection

Restricted ports, intrusion detection & OS hardening.

API Integrations

Connect with ERP, accounting, and banking platforms securely.

Data Minimisation

Only necessary risk and financial fields are stored.

Secure Admin Access

SSH keys, MFA and hard controls around production access.

Uptime Monitoring

Real-time uptime, performance, and reliability tracking.

Flexible Commercial Models

Choose between a SaaS subscription or a perpetual licence, depending on how you prefer to operate and capitalise technology.

Option 1

Perpetual Licence

Large to Medium sized lenders purchase a licence to operate LendMetrics internally, with Liquital providing hosting, maintenance and ongoing support.

- • Perpetual software licence

- • Liquital-managed hosting & updates

- • Technical support and refresher training

- • Cost: Contact Us

Option 2

SaaS Subscription

Liquital hosts and manages the entire platform on the cloud, with subscription fees linked to portfolio scale and active loans.

- • Once-off setup & onboarding fee

- • Monthly subscription linked to active loan book

- • Includes hosting, maintenance & updates

- • Access for credit, risk, finance & operations teams

- • Cost: Contact Us

Why LendMetrics

Designed specifically for African and emerging-market lenders operating in high-velocity lending environments.

Built for Lending Entities

Configured for Credit Products including Term Loans, Working Capital Solutions and Bonds.

Risk & Profitability in One View

Combine credit metrics and profitability analytics, so you know which clients and deals truly create value over time.

Low-Friction Implementation

Delivered in 3-4 months with configuration, data migration support and training – without replacing your core systems.

Ready to Modernise Your Lending Stack?

Deploy LendMetrics in 3–4 months. We deploy Professional services to your offices to ensure we tailor the platform to your needs.